What I Wish I Knew Before I Bought Term Insurance

by Jim Oliver, CreateTailwind

I’m going to be honest with you. I bought term insurance once. And I thought I was making a smart, low-cost, “responsible adult” decision.

But I was wrong. Not because term insurance is inherently bad—it’s not.

It’s just incomplete. It’s a temporary patch, not a long-term strategy. And the day I realized what I had really signed up for, I was angry—at myself, at the financial industry, at how poorly we’re taught to think about money.

So if you’re thinking about buying term insurance, or you’re holding a policy right now, here’s what I wish someone had told me before I signed the dotted line.

1. Term Is a Bet—And the House Always Wins

Term insurance is simple:

You pay a small premium to get a large death benefit… for a limited amount of time. 10, 20, 30 years—then it’s gone.

Now here’s the kicker:

Less than 2% of term policies ever pay out.

That means more than 98% of the time, the insurance company keeps every penny you gave them—and you walk away with nothing.

It’s like renting a parachute that only works if you jump out of the plane during a specific window of time. Otherwise, too bad. No refund.

Meanwhile, they made money off your money the whole time.

And here’s what most people don’t realize: when you buy term, you’re betting against the insurance company—and they’ve got actuarial science on their side. They know the numbers. They know the odds. And they know exactly how to price the policy so that your money works for them, not you.

2. It’s Cheap for a Reason

When I bought term, I was sold on “cheap.”

Low monthly cost. Simple. “Just in case.”

But I didn’t stop to ask: What’s the catch?

Here’s what I learned:

- You build no equity

- You have no living benefits

- It disappears the moment you stop paying or the term ends

- You lose control of your cash flow and your financial strategy

Cheap is never the same as efficient.

A whole life policy (properly designed for cash value) costs more—but it does more.

It gives you liquidity. It gives you leverage. And it keeps growing, guaranteed, for the rest of your life.

3. I Was Thinking in Scarcity, Not Strategy

When I bought term insurance, I was operating from a scarcity mindset:

“I can’t afford anything more right now.”

“I’ll just get by until later.”

“This is just to cover my family in case something happens.”

I was protecting a worst-case scenario, instead of building for the best-case scenario.

What I didn’t realize was that there’s a better way to do both.

Infinite Banking (IBC) isn’t about protection alone—it’s about ownership.

It’s about building a system that protects and produces.

Term insurance is about death.

Whole life (properly structured for IBC) is about life.

4. I Didn’t Understand Opportunity Cost

What did my term premium cost me?

Let’s say I spent $50/month for 30 years. That’s $18,000 out-of-pocket.

Now imagine I had put that same $50/month into a high-cash-value whole life policy. It would’ve grown tax-free, been available for policy loans, and generated uninterrupted compounding growth.

But instead, I let that money die in someone else’s business model.

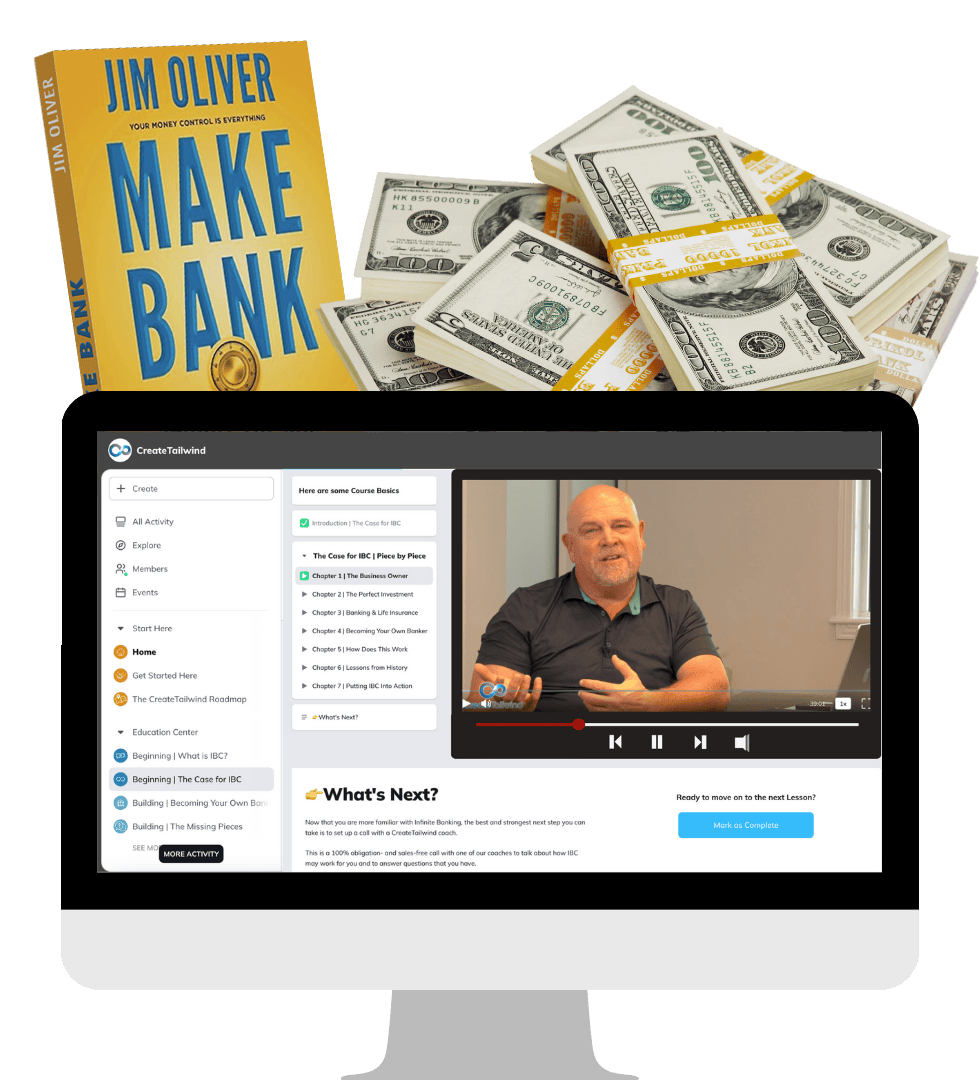

At CreateTailwind, we show you how to stop renting your financial future—and start owning it.

5. It Wasn’t a System—It Was a Silo

Term insurance is a silo.

It doesn’t talk to your investment strategy. It doesn’t integrate with your business. It doesn’t produce capital. It doesn’t recycle your dollars.

But Infinite Banking? That’s a system.

Your policy becomes a source of capital.

It funds real estate. It buys businesses. It handles emergencies. It creates freedom.

And it doesn’t expire on your 65th birthday.

So, What Should You Do?

If you’ve got term right now, don’t panic.

But start asking better questions.

Here’s what I’d suggest:

- Look at what you’re really paying. What’s the lifetime cost of your term premium, and what could that money have earned you?

- Consider what you want your money to do for you. Do you want it to just sit and wait for death—or do you want it building your wealth while you’re alive?

- Ask yourself what control feels like. Term gives you a death benefit. IBC gives you a living benefit—and a system to create cash flow, year after year.

Look, I don’t hate term insurance.

I just hate what it replaces when people don’t know better.

It’s like bringing a butter knife to a gunfight.

Cheap, dull, and totally unfit for the job you’re actually trying to do—build wealth, create freedom, and protect your legacy.

Whole life with IBC is a different conversation.

It’s a different strategy.

It’s the foundation of a system that works whether you’re 25 or 65, broke or flush, just starting out or scaling up.

If you’re ready to stop playing defense and start building something that lasts, join us in the CreateTailwind community.

We’ll walk you through it.

No sales pitch. Just clarity, confidence, and control.

Let’s go.