When you first hear about the Infinite Banking Concept (IBC), it sounds simple: use a whole life insurance policy to build your own personal banking system.

But once you get into it—really use it—you realize something:

This isn’t just a financial strategy. It’s a financial revolution.

IBC isn’t about chasing higher returns. It’s about building a system that puts you in control of your money—and keeps it compounding for the rest of your life. And the deeper you go, the more benefits you unlock. Some are expected. Most are not.

Here’s a breakdown of the top benefits—both the ones you know to look for and the ones that surprise you after you’ve been doing this for a few years.

✅ The Commonly Known Benefits of IBC

Let’s start with the benefits everyone talks about—and for good reason.

1. Liquidity, Use, and Control

You don’t have to ask anyone for permission to use your money. Your cash value is accessible via policy loans whenever you want it, for whatever you want.

- No applications

- No credit checks

- No bank underwriting

You control the terms. You decide when to borrow, how much, and if or when to pay it back.

2. Uninterrupted Compound Growth

This is where the magic happens.

Even when you borrow against your policy’s cash value, your full cash value continues to grow as if you never touched it. Why? Because you didn’t withdraw the money—you borrowed against it.

This is how you make your money work in two places at once.

Example:

- You have $150,000 in cash value.

- You borrow $100,000 to buy a fourplex.

- The full $150,000 keeps compounding inside the policy, while your investment cash flows outside of it.

It’s not a trade-off—it’s multiplication.

3. Tax Advantages

- Tax-deferred growth of cash value

- Tax-free access through policy loans

- Tax-free death benefit to your heirs

- No capital gains tax on policy growth

- No income limits or contribution caps

IBC gives you a private, tax-advantaged environment to grow wealth outside of government-controlled retirement plans.

4. Private Wealth System

No reporting to the IRS on loans. No government limits on how much you can contribute. No Wall Street volatility. No one dictating where or how you deploy your capital.

This is off the grid, private, and totally within your control.

5. Permanent Life Insurance

It’s easy to forget this part—but the death benefit is real. When structured properly, IBC policies ensure that no matter what happens to you, your system lives on for your family or business.

This isn’t a cost—it’s a legacy asset.

🔍 The Unexpected Benefits of IBC

Now let’s talk about the ones no one tells you about up front. These are the reasons people stick with IBC for decades—and why it transforms the way they think about money forever.

1. Peace of Mind During Financial Chaos

You ever notice that the people panicking during market crashes are the ones with their wealth tied up in Wall Street?

IBC users aren’t worried. Their money isn’t riding the rollercoaster.

When you have access to liquid capital, you don’t panic—you capitalize.

During COVID, while everyone else was hoarding cash, many IBC practitioners borrowed against their policies to:

- Buy discounted real estate

- Expand businesses

- Refinance debt at better terms

While others froze, they moved. Why? Because they had access to cash.

2. Opportunity Readiness

The people with capital win—not because they’re smarter, but because they’re prepared.

With IBC, you’ve always got a war chest ready.

Example:

- You build up $200,000 in cash value.

- An off-market property deal lands in your lap.

- You fund the down payment through a policy loan in days—not months—and close fast.

- You earn cash flow and equity without touching a bank.

IBC puts you in a position to say yes when others can’t even show up.

3. Zero-Loss Lending Experience

When you borrow against a typical asset (like selling stocks or draining savings), you lose access to future growth.

With IBC? You don’t.

You keep earning while your capital is out doing other work.

It’s the only place in the world where you can use your money without losing the growth on it. And once you see that in action, you’ll never want to use your dollars the old way again.

4. It Changes How You Make Every Financial Decision

This one’s hard to explain until you live it.

When you use IBC, you start to ask different questions:

- “How can I keep my money moving?”

- “What’s the cost of not using leverage here?”

- “How do I repay myself like a banker, not a borrower?”

You stop thinking like a consumer and start thinking like a capitalist.

It’s not just a tool—it’s a mindset.

5. Your Money Learns to Work Harder Than You Do

When you combine:

- IBC compounding

- Asset cash flow

- Strategic policy loan repayments

…you create a self-sustaining wealth system.

You no longer rely on earned income to build wealth. Your money does the heavy lifting.

What This Looks Like in Real Life

Let’s say you fund a policy with $30K/year for five years. By year 5, you’ve got about $130K in cash value.

You borrow $100K to put down on a $400K rental property:

- Cash flow: $1,500/month = $18,000/year

- Appreciation: 3%/yr = $12,000/year

- Policy growth: 4.5% on $130K = ~$6,000/year

That’s $36,000 in value per year across cash flow, appreciation, and policy growth.

Meanwhile, you can structure policy loan repayments on your terms—no bank involved, no hit to your credit, no paperwork.

Try getting that from a 401(k).

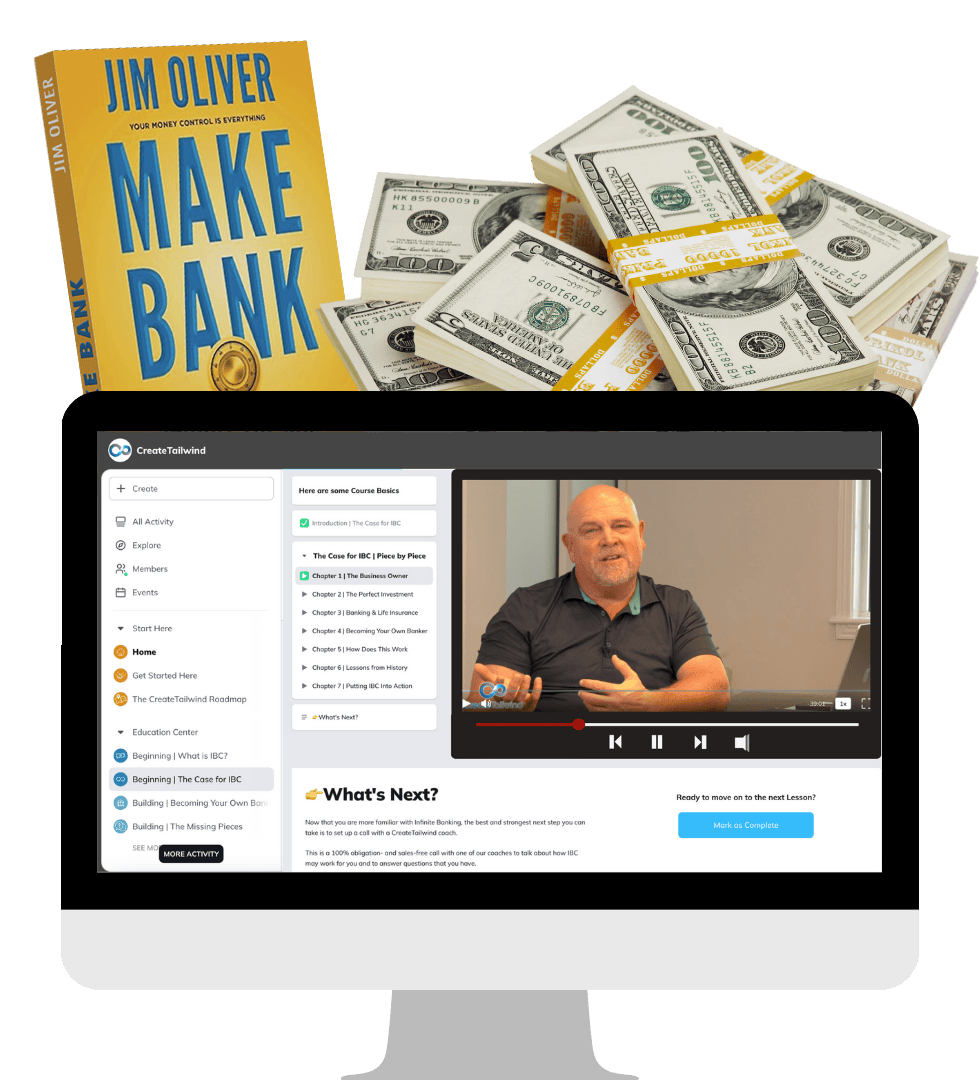

Look, most people try to get better results by changing the investment.

At CreateTailwind, we change the system.

The Infinite Banking Concept is not about better returns. It’s about better control.

- Control of your capital

- Control of your timing

- Control of your legacy

That’s the real benefit—and once you experience it, there’s no going back.

If you’re ready to stop renting your financial life from the banks, and start owning the entire system, then welcome to IBC.

This is the first step. And we’ll walk with you every mile. Let’s build something that actually lasts. Let’s build your tailwind.

Let’s go.