Average Returns

Average returns are generally calculated by taking the sum of annual returns over a period and dividing by the number of years. While useful for a broad overview, they don’t fully account for the year-to-year volatility or the impact of significant losses.

Actual Returns

Also known as the compound annual growth rate (CAGR), actual returns provide a more accurate measure by considering the effect of compounding, crucial for understanding how investments truly grow over time.

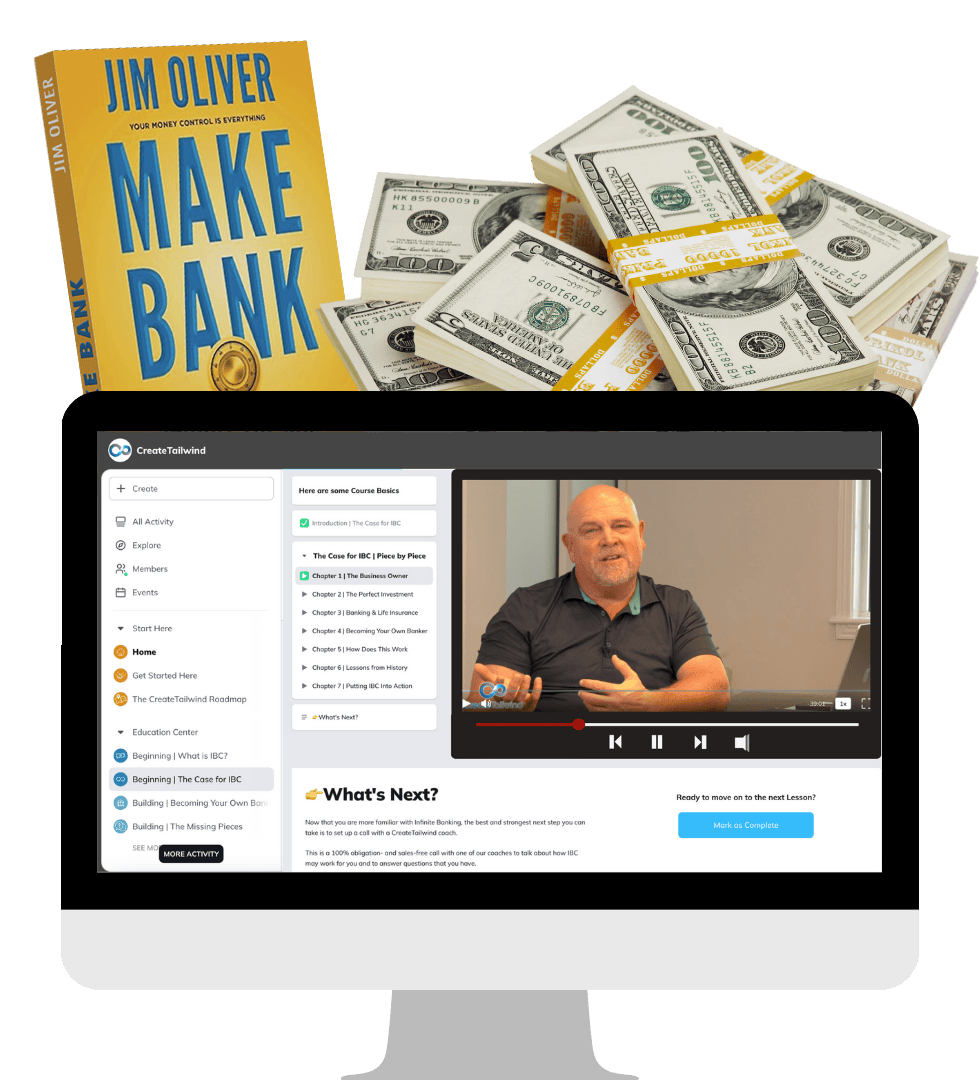

Traditional Retirement Accounts vs. Infinite Banking

While IRAs and 401Ks showcase attractive average returns in their reports, these are misleading because they don’t capture market volatility and the fluctuation of actual returns. In contrast, IBC leverages the stable, predictable growth of whole life insurance cash values, highlighting the significance of actual returns.

To illustrate the impact of average vs. actual returns, let’s consider two hypothetical scenarios:

John’s Traditional Retirement Portfolio

John has $1,000,000 invested in a combination of IRAs and 401Ks. Initially, these accounts show an average annual return of 8%. However, due to market fluctuations, there are years with negative returns which significantly affect the portfolio’s growth:

- Year 1: +10%

- Year 2: -3%

- Year 3: +15%

- Year 4: -12%

- Year 5: +9%

Although the average return suggests a steady upward trend of 8%, the actual growth is 3.31% annually. This is due to the sequence of returns and market volatility, which results in a lower than expected accumulation of wealth. By the end of year 5, his initial $1,000,000 might only grow to about $1,160,000 due to the negative impacts in years 2 and 4, despite positive years offsetting some losses.

Jane’s IBC Strategy

Jane, on the other hand, employs a whole life insurance policy with $1,000,000, using it within the IBC system. Her policy guarantees a growth rate of 4% annually, compounded. This rate is not subject to market fluctuations and is guaranteed by the insurance company:

- Year 1: +4%

- Year 2: +4%

- Year 3: +4%

- Year 4: +4%

- Year 5: +4%

At the end of the same five-year period, Jane’s policy would reliably grow to about $1,216,653, thanks to the power of compounding at a steady rate. More importantly, her returns are actual and not just average, reflecting real, predictable growth without the risk of market downturns.

This comparison between John and Jane highlights the critical difference between average and actual returns in financial planning. John’s experience with IRAs and 401Ks, while potentially offering higher average returns, comes with significant risk and unpredictability. Add in the fees and taxes, and the take home rate is far less. In contrast, Jane’s use of IBC with a whole life insurance policy offers a more stable and secure growth path, ensuring that her financial goals are met with less risk and more predictability.

If you’ve been reading our articles, then you know this is just one benefit of IBC. But, for anyone looking to build wealth with greater control, using actual returns is a key factor in creating more stable security for you and your family, today and in the future.