Most people are trained from day one to hand their money over to Wall Street. Put it in a 401(k), let it “grow,” and pray it’s there when you need it. That’s not a strategy—that’s gambling.

But unlike a weekend in Vegas, these aren’t chips you’re sliding across the table. This is your financial stability. Your family’s future. The roof over your head, the business you’re building, the retirement you’ve been promised. And the odds? They’re stacked against you.

When the market tanks, so does your freedom. Vacations get canceled, retirements delayed, business opportunities slip away. You’re left waiting for someone else to tell you when it’s safe to live your own life.

There’s a better way. You don’t need Wall Street’s permission slips. You can reclaim the banking function, build your own system, and make your money compound uninterrupted—while using it to buy assets, expand your business, and secure your future.

This isn’t about abandoning the market completely – it’s about breaking dependence and taking ownership. The process is simple: rebalance, redirect premium flows, use internal loans, and reallocate assets.

Let’s walk through it step by step, with real numbers.

Step 1: Rebalancing Away from Market Dependence

Case Study: Mike & Sarah, mid-40s entrepreneurs

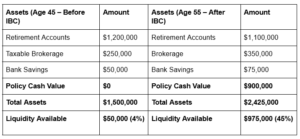

- Before: $1,200,000 in retirement accounts; $250,000 taxable brokerage; $50,000 in bank savings. Their annual household income is $400,000, with $100,000 flowing into brokerage and retirement each year. Net worth tied 85% to the market.

- Problem: No control. If they need liquidity, they either sell shares at a loss, or borrow at bank terms.

Rebalance Plan: Shift a portion of annual contributions into high-cash-value whole life policies. For example, instead of putting $100,000 into brokerage/retirement, redirect $70,000 into policies and continue $30,000 into market accounts.

Impact in Year 5:

- Cash Value in policies: ~$325,000 available, guaranteed and liquid.

- Brokerage: ~$425,000 (subject to market risk).

- Liquidity Ratio: improved from 4% to 30%.

Step 2: Structuring Premium Flows

Premiums are not an “expense.” They are a redirection of savings into a system that compounds uninterrupted.

Tactics:

- Fund policies annually with disciplined contributions.

- Use business cash flow or redirected retirement contributions.

- Build multiple policies (husband, wife, even business) for higher premium capacity.

Mike & Sarah’s Example:

- Year 1: $70,000 premium creates ~$55,000 immediate cash value.

- Year 2: Another $70,000, total cash value ~$120,000.

- By Year 5: $325,000 cash value, still growing even while loans are outstanding.

Step 3: Internal Loans for Major Purchases

Instead of draining brokerage or begging banks, use policy loans.

Example Transaction:

Mike buys $150,000 of equipment for his business in Year 6.

- Traditional Path: Finance with a bank loan at 8% interest. Total outflow over 5 years = ~$182,000.

- IBC Path: Borrow $150,000 from policy, continue compounding on full $400,000+ of cash value. Repay the policy at the same 8% terms, but every dollar of “interest” flows back to their system.

Result:

- By Year 10, their cash value is ~$600,000 (net of the loan).

- They’ve recaptured ~$32,000 of interest that would’ve gone to the bank.

Step 4: Asset Reallocation Over Time

This isn’t an overnight jump. It’s a decade-long pivot.

Balance Sheet: Before vs. After

The big shift here isn’t that Mike and Sarah swore off the stock market forever. It’s that they stopped depending on it. They built almost a million dollars of guaranteed, liquid, tax-advantaged capital—a personal banking system they own and control.

Here’s the reality: if Wall Street is your only strategy, you’re gambling with your family’s future. You’re betting on a game where the house always wins.

When you redirect cash flow into policies, use internal loans, and steadily reallocate assets, you flip the table. You stop playing the game and start owning the bank. That’s when your money works for you every single day—compounding, liquid, and under your command.

This transition isn’t flashy. It’s not overnight. But it’s deliberate. And the payoff is everything Wall Street can’t give you: control, confidence, and the ability to finance your life without asking permission.