Let’s skip the pep talk: you already know the system is rigged. Banks profit from your deposits, Wall Street skims your returns, and the average “retirement plan” is a leash disguised as security.

So the question isn’t what’s wrong with the system—it’s why do so many still think like employees instead of owners?

The Cultural Code Running in the Background

Most money behavior isn’t logical; it’s cultural.

We inherited a saver’s operating system:

“Be careful. Pay off debt. Save what’s left. Don’t take risks.”

That story worked for our grandparents, but it collapses in today’s economy. It trains people to be cautious when they should be in control. It rewards obedience, not ownership.

A saver feels safe when dollars don’t move.

A capitalist feels powerful when dollars multiply.

You can’t play offense with a defensive playbook.

The Behavioral Trap: Why Smart People Stay Stuck

Behavioral science calls it status quo bias: we prefer familiar pain over unfamiliar freedom.

That’s why even high earners keep funneling money into accounts they can’t touch until they’re 59½. It’s not ignorance—it’s identity. They still see themselves as savers trying to be “responsible.”

To break out, you must change the story you tell yourself.

Not, “I’m investing.”

But, “I’m deploying capital. I’m building systems. I’m the bank.”

That’s what CreateTailwind teaches: not how to play the old game better, but how to own the game entirely.

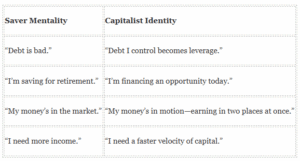

What a Capitalist Identity Looks Like

This isn’t philosophy. It’s mechanics and math. Let’s look at it in action.

Case Study: How One Owner Created a Six-Figure Swing

Before:

Sarah, age 42, earned $185,000 as a consultant. She was saving $3,000/month—split between her 401(k), savings account, and a “high-yield” money market. She had $120,000 sitting idle, earning 4.2%.

After taxes and inflation, her real return was under 1%. Her money was safe but sterile.

The Shift:

She redirected her savings into a properly structured Infinite Banking policy. In year one, she contributed $100,000 of capital. Her cash value after costs was $87,000 and began compounding immediately.

At month seven, she borrowed $70,000 from her policy and used it as a down payment on a $350,000 four-unit rental property. The property produced $2,450/month in net cash flow.

She applied $1,200/month to repay her policy loan while pocketing $1,250/month in profit. Meanwhile, her entire $100,000 policy continued to grow tax-advantaged and uninterrupted.

After 3 Years:

- Policy cash value grew from $87,000 → $126,000 (even with loans outstanding)

- Property equity grew from $70,000 → $135,000

- Cumulative cash flow collected: ~$45,000

- Total combined capital position: ~$306,000

Before, her $120,000 was earning ~$4,800/year.

After, her system produces over $40,000/year in cash flow while compounding growth inside the policy.

Same dollars. Different system. New identity.

Building Your Own Capitalist Code

- Audit your programming.

List every money belief you inherited. Then ask: did that idea serve me—or the system? - Rebuild your definitions.

Saving = storing capital for deployment.

Debt = control of capital.

Retirement = cash-flow independence. - Create your warehouse of wealth.

Your Infinite Banking system is your private reserve. Liquidity, safety, and control—all in one place. - Operate like a business.

Track your personal economy. Finance through your system. Recycle dollars until they’ve earned multiple times. - Join a new tribe.

You can’t build a capitalist identity surrounded by savers.

Surround yourself with owners inside the Wealth Engine Community — www.wealthenginecommunity.com.

That’s where entrepreneurs, investors, and business owners share how they move money, create velocity, and build systems that serve them, not Wall Street.

The Payoff

When you stop trying to save your way to freedom and start owning the flow of money, everything accelerates.

Control replaces uncertainty.

Velocity replaces stagnation.

Confidence replaces hope.

That’s the real meaning of breaking free from the herd. Not rebellion — ownership.

The herd survives by saving.

Owners thrive by creating.

Be the owner.

Be the bank.