Subtitle: Why Taking Control of Your Money is More Important Than Ever

In today’s rapidly changing financial landscape, concerns about bank instability have become a hot topic of discussion. Recent failures and government interventions have left many people worried about the safety of their deposits and the long-term viability of traditional banking systems. However, amidst these uncertainties, there is a solution that empowers individuals to take control of their money and protect their wealth – Infinite Banking.

Understanding Bank Instability: Beyond the Headlines

As recent events have shown, the banking system can be susceptible to failures, triggering concerns among depositors. While government interventions may be portrayed as necessary measures, it’s essential to critically analyze the situation and see beyond the rhetoric. Every taxpayer’s dollars are ultimately involved, making it crucial for individuals to care and be vigilant.

The Vulnerability of Deposits and Seeking Alternatives

For depositors with funds exceeding the FDIC limit, the safety of their money becomes a pressing concern. While smaller bank failures may still be protected by the FDIC, a widespread run on banks can pose a risk. In such uncertain times, it’s important to explore alternatives to traditional banking that offer more security and control.

The Wisdom of Nelson Nash and Infinite Banking

Nelson Nash advocated for taking the banking function back to the individual level. He emphasized the significance of treating banking as a process rather than focusing solely on products. By doing this, you can regain control over your financial life.

In Infinite Banking, we do this by using the mutual insurance company. These companies have a strong track record of stability and resilience, with zero instances of going out of business since 2001. Unlike commercial banks, mutual insurance companies are heavily regulated and have high capital surplus ratios, ensuring the safety of policyholders’ funds.

Benefits of Mutual Insurance Companies

The difference is that mutual insurance companies prioritize the security of their policyholders’ money instead of spending it. Their investment strategies are conservative, focusing on treasuries and bonds, which provide stability and long-term returns. Furthermore, the industry’s stringent regulations restrict investments in volatile assets like real estate, minimizing the risk associated with market fluctuations.

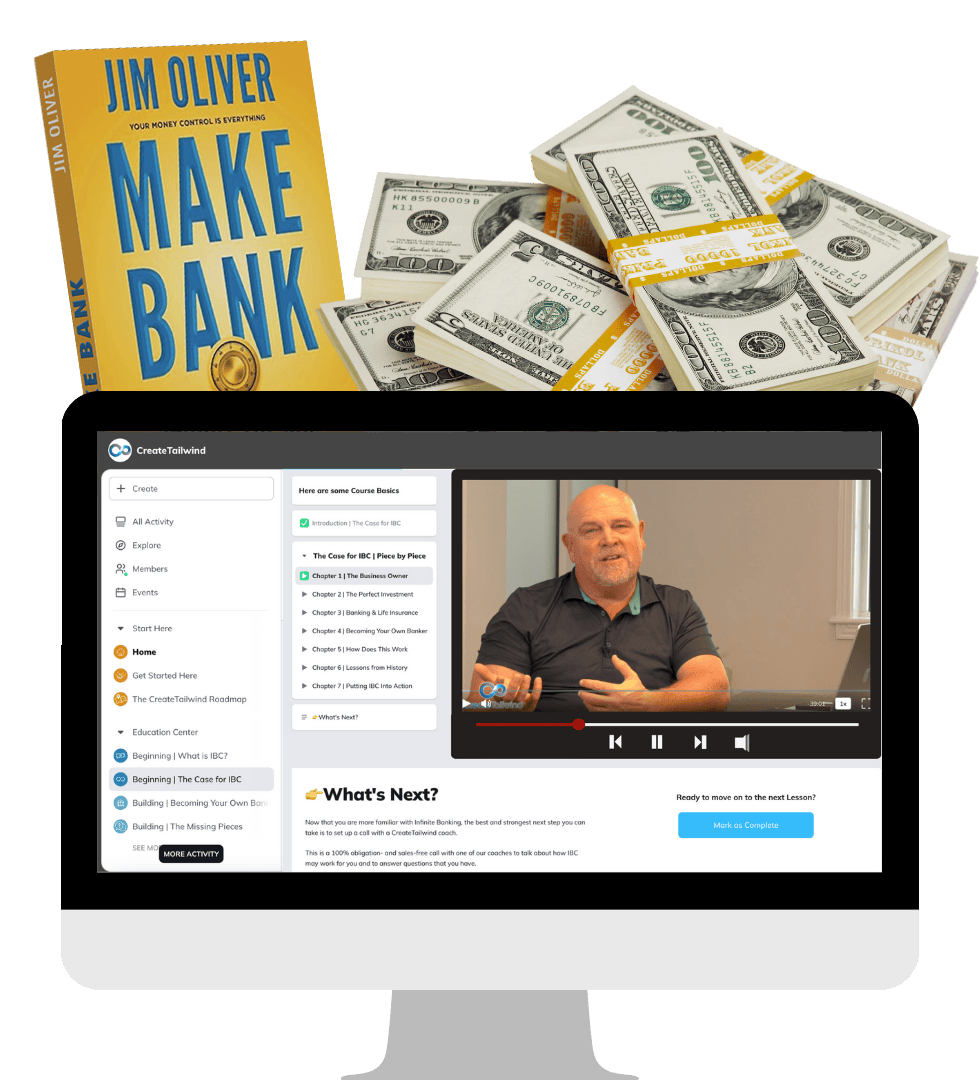

Building Wealth and Maintaining Financial Control

The key advantage of Infinite Banking lies in its ability to protect and grow your wealth over time. Unlike traditional banking, where profits are skewed in favor of the bank owners, IBC enables individuals to build a personal banking system that benefits them directly by empowering them to make their own strategic financial decisions, such as paying back loans or reinvesting in their Infinite Banking system.

Securing Your Future: The Power of Infinite Banking

In times of financial uncertainty, it is vital to reassess the safety and control of your money. While traditional banking can leave depositors vulnerable, Infinite Banking offers a reliable and empowering alternative. By taking advantage of the stability and long-term profitability of mutual insurance companies, individuals can safeguard their finances.

To listen to Jim and Nick discuss this topic on the Breakaway Wealth podcast, click here.