Achieving Financial Independence Early: IBC for Millennials

Financial independence isn’t just a dream; for the millennial generation, it’s becoming a necessary pursuit. Amidst rising costs and economic shifts, establishing financial stability is more crucial than ever. Enter IBC, a transformative strategy that’s not just about saving but about making your money work for you.

Unlocking the Power of IBC with Whole Life Insurance

The Basics of Whole Life Insurance

Whole life insurance isn’t the dusty, old-school tool you might think it is. It’s actually a dynamic vehicle for building wealth thanks to:

- Guaranteed Growth: Your cash value grows each year, no matter what the market does, making it a rock-solid component of your financial strategy.

- Lifelong Coverage: Beyond just a payout upon death, this is a financial asset that offers living benefits, like accessing cash value during your life.

- Tax Benefits: Growth within a whole life policy is tax-deferred, and accessing your money through loans is tax-free.

How IBC Elevates This

IBC isn’t just about having insurance; it’s about becoming your own banker. Forget waiting on loan approvals or paying interest to financial institutions. With IBC, your cash value becomes your personal lending library.

Step-by-Step: Implementing IBC for Financial Freedom

Step 1: Deep Dive into IBC Knowledge

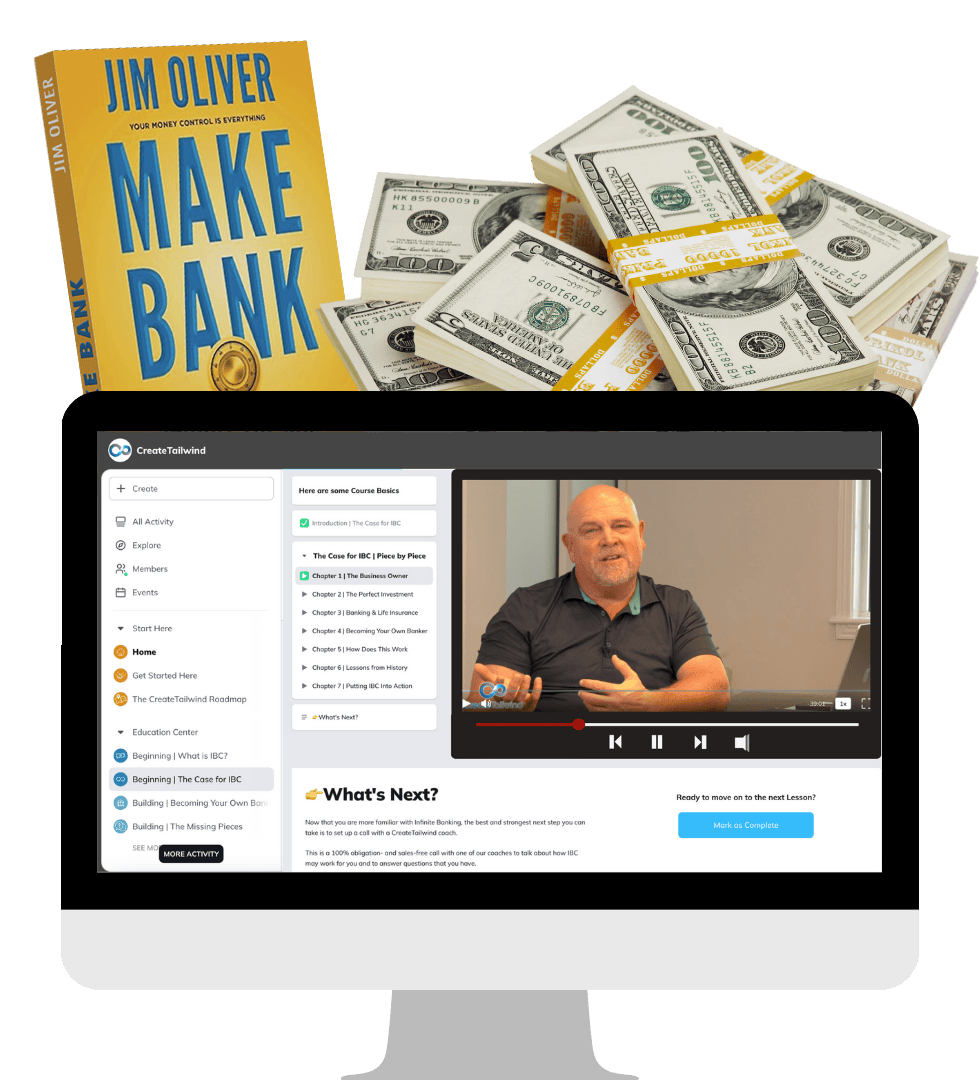

- Educational Foundation: Start with R. Nelson Nash’s book “Becoming Your Own Banker.” It’s not just a read; it’s your financial playbook.

- Learning from Leaders: Engage with content from Jim Oliver, attend a seminar, or jump into a webinar. Knowledge is your greatest asset.

Step 2: Assess and Align Your Finances

- Financial Self-Audit: Know where every dollar goes. Understanding your inflow and outflow is crucial.

- Setting Clear Goals: What does financial independence look like for you? Define it, so you can achieve it.

Step 3: Partner with an IBC Expert

- Finding Your Financial Coach: Connect with an IBC-trained financial advisor. This isn’t about buying a policy; it’s about designing your financial future.

- Customized Policy Design: Work with your advisor to craft a policy that grows with you, maximizes your financial input, and meets your unique needs.

Step 4: Activate and Utilize Your Policy

- Capitalizing on Time: The sooner you start, the better. Your policy’s growth is exponential.

- Beyond Premium Payments: Pump up your premiums when possible. Think of it as paying into a savings account that pays you back.

- Leveraging for Life Goals: Use your policy to fund life’s big tickets—down payments, business ventures, or even that dream sabbatical.

Step 5: Review and Optimize

- Regular Financial Check-Ins: Sit down with your advisor annually. Adjust strategies as your life and goals evolve.

- Scaling Up: As your financial landscape grows, consider increasing your contributions or starting new policies to keep pace with your ambitions.

To truly revolutionize your financial journey, we invite you to join the free CreateTailwind community at community.createtailwind.com. Here, you’ll access a wealth of free resources including classes, workshops, and a library of content. Engage with a community of like-minded individuals all striving towards financial freedom.

Step into your financial future today—empowered, educated, and unstoppable!