Why Vehicle Financing Is a Trap & How to Escape It

Breakaway Wealth: Episode 10 – Every year around the holidays, car dealerships and vehicle manufacturers become very “giving” with 0% interest deals, but what is their real reason for doing this? If they are giving us zero interest, how are they making any money? Is saving up for a car and buying it with cash a better option? On this episode, we reveal the truth about vehicle financing, how it hurts us in the long run, and the better way of buying a car.

“We finance everything we buy, regardless of how we pay for it.” -Jim Oliver

Get the Episode on YouTube:

Three Things We Learned from this Episode

Why “0% interest” is really a bait and switch Don’t get trapped by “0% interest rate” marketing. There’s always a hidden rebate or a rebate only on the front end. You’ll end up paying as much as a 6% interest.

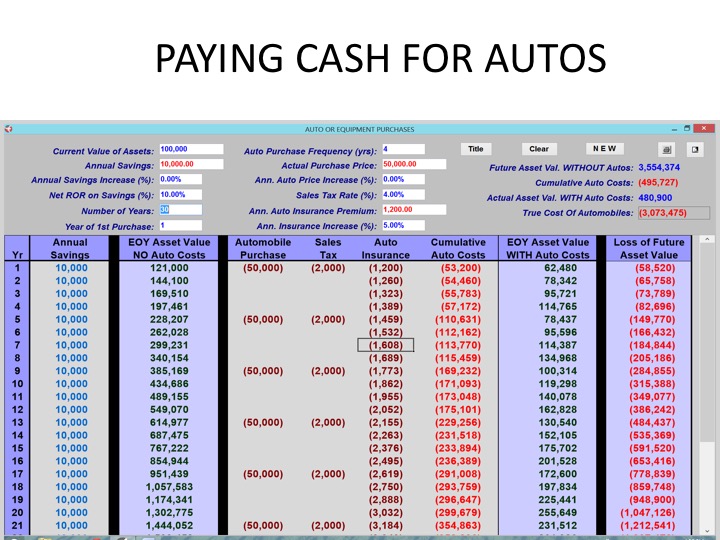

Is saving up for a car a good idea? Often, we’re encouraged to avoid the vehicle financing trap by saving up and buying the car with cash, but this is still not the best method. The constant saving and spending will end up affecting your compound savings in that process. Every time we take money out of savings, it’s not growing anymore, and that opportunity is gone forever.

Why banks don’t want us to be educated and empowered Financial institutions don’t want an educated consumer. They want an uneducated consumer they can take advantage of. If we don’t know what’s going on, we can easily get distracted by a 0% interest vehicle financing, instead of seeing it for what it really is— a way to make money flow away from us.

The conventional means to buying a car like financing or buying cash, aren’t actually the most beneficial. As Todd Langford put it, you’re either paying up interest by financing or passing up interest by paying cash. That’s why we need to be careful about the so-called “specials” we sign up for. What we must learn to do is to keep our money within our own banking system. That will mean it always flows back to us, and we get all the benefits like compound interest on our side. The key is becoming an educated consumer so you can avoid getting taken advantage of.

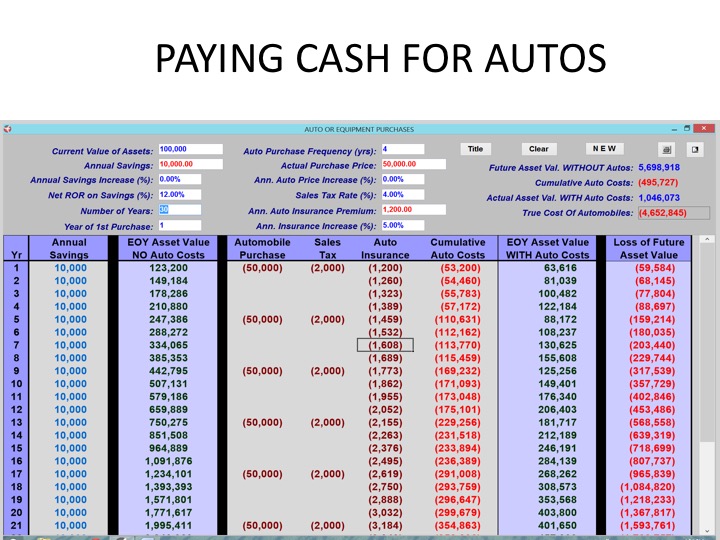

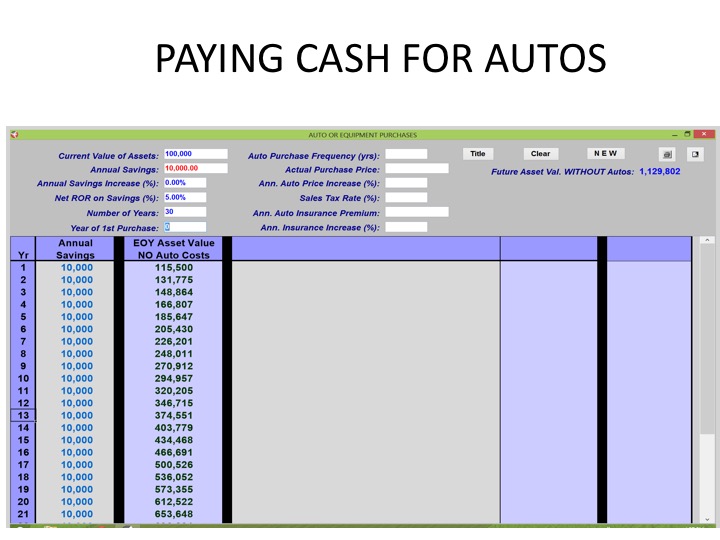

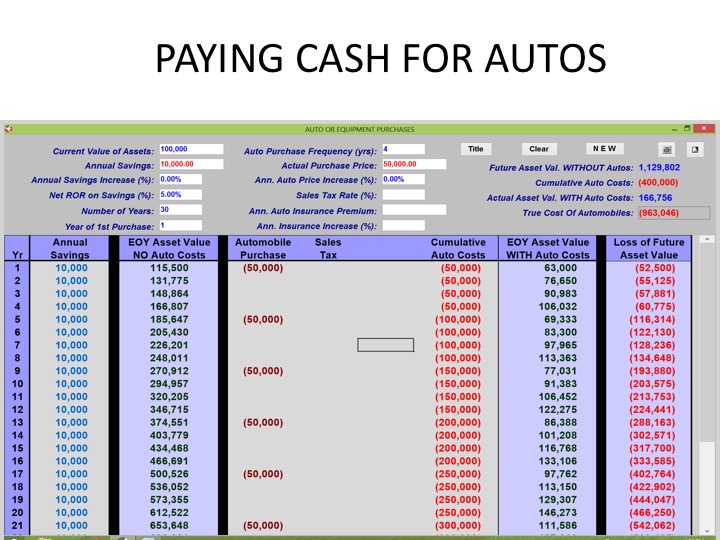

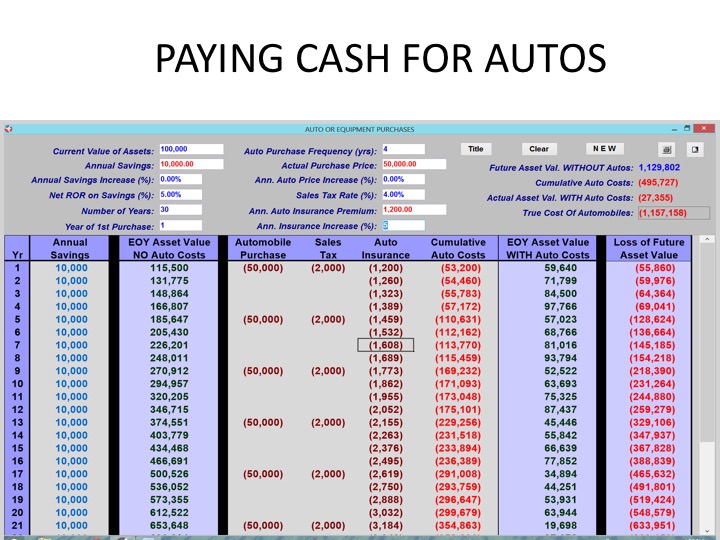

Illustrations from our discussion:

Figure 1:

Figure 2:

Figure 3:

Figure 4:

Figure 5: